×

![]()

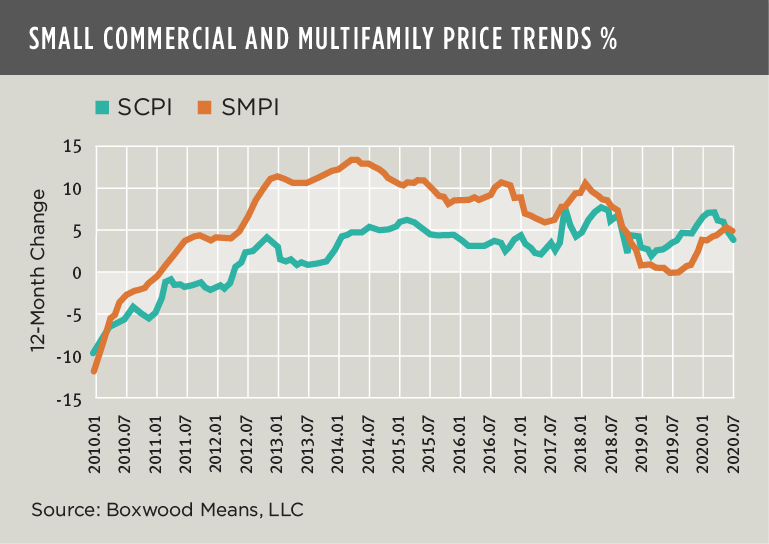

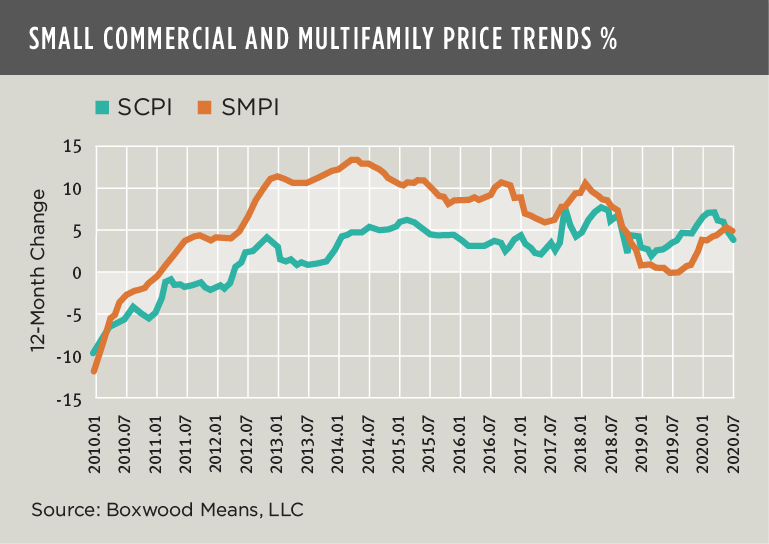

Small-cap multifamily properties are proving resilient during the pandemic-induced recession. Occupancies have remained strong, and investors appear to be looking passed increased trends in payment interruptions and the specter of possible tenant evictions. As a result, small-cap multifamily prices have outperformed small commercial asset prices.

Small multifamily prices rose 0.2% preliminarily during July that raised the year to date performance to 2.6% according to Boxwood’s national Small Multifamily Price Index (SMPI) that tracks prices of apartment sales under $5 million across 100 metro areas. Most notable was the recent acceleration in SMPI’s 12-month return that, at 5% during the latest period, extended the streak of annual increases of 5% or better over three consecutive months. (See the nearby graph.)

Despite this solid price performance, recent data suggests that the ongoing recession may create some further volatility ahead in terms of rental payments. According to July data from RealPage, monthly payments from tenants living in Class B apartments was 94.0%. While this figure was better than the 92.5% collection rate from Class A assets, only 88.2% of tenants residing in Class C properties remitted monthly payments.

Meanwhile, the recent softness of small-cap commercial prices continued into July with a second consecutive 0.2% loss according to Boxwood’s national Small Commercial Price Index (SCPI) that combines sales in over 160 markets. On strength earlier this year, SCPI has eked out a 0.9% gain YTD, and the 3.8% increase over 12 months, though healthy, has declined for five months and is the lowest annual return since July of last year.

We expect that space market fundamentals during third quarter will be as weak or worse than the second quarter results, thereby further deterring investors from bidding up asset prices. July’s preliminary $12 billion in small-cap commercial sales was off 35% YOY, and the total of $93 billion YTD represented a 27% decline versus 2019.

Check back later this month for our analysis of small-cap CRE fundamentals through third quarter.

Randy Fuchs

Randy Fuchs