×

![]()

CRE market fundamentals have weakened considerably as small businesses struggle to stay open and/or make do with lower business activity precipitated by the persistence of COVID-19. The impact on small-balance commercial lending is increasingly clear-cut: loan origination volume is contracting, and banks are pivoting towards managing the growing credit risk of their CRE portfolios.

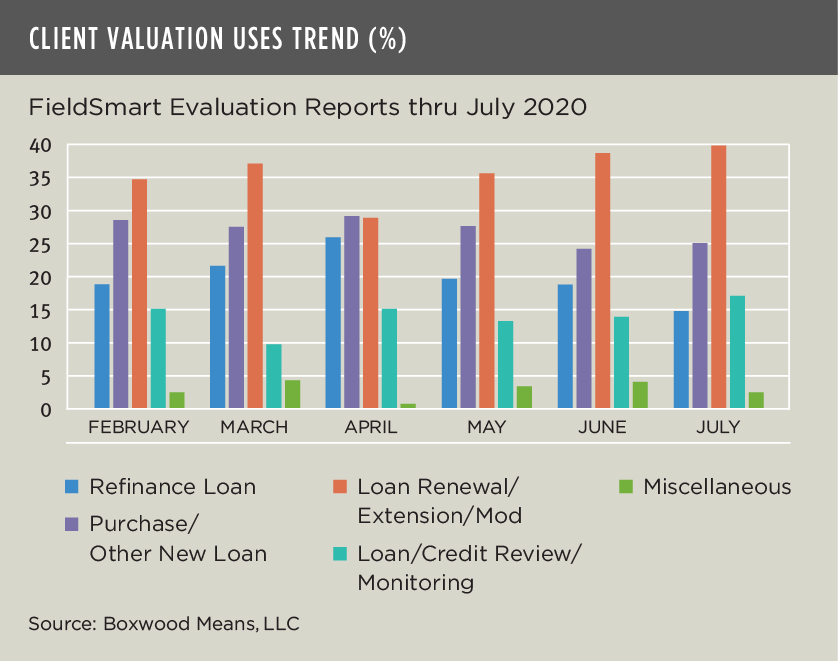

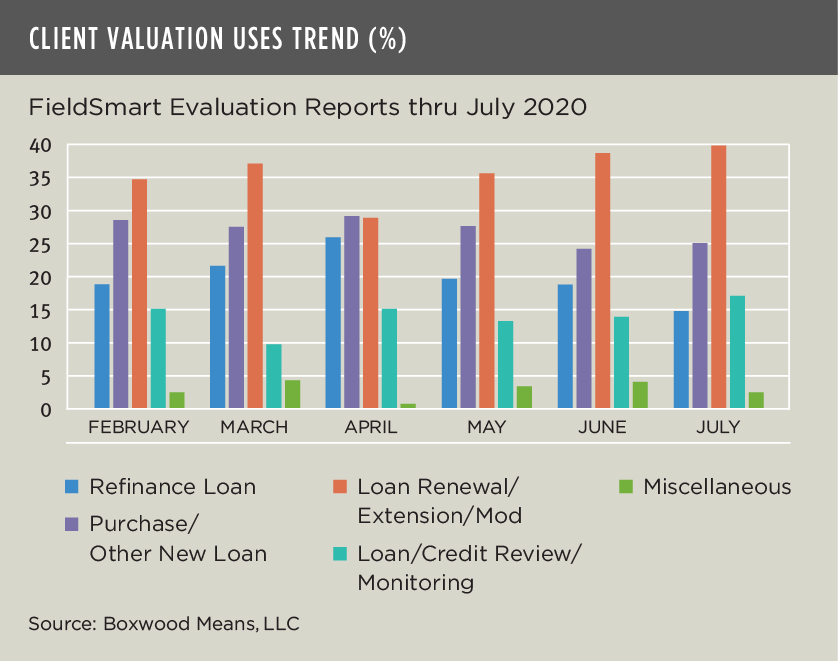

Boxwood's analysis of July procurement data on clients' use of our FieldSmart Evaluation reports confirms that bankers’ apprehension about collateral quality has escalated beyond first-wave investigations of and forbearance actions for retail and hospitality credits to additional, exposed businesses and property types. This expansive view is prudent as small-cap CRE conditions and the economy falter, and the PPP loans that have briefly kept many Main Street firms afloat are exhausted.

Key takeaways from our July analysis include:

- FieldSmart orders for refinance loans plummeted five percentage points from the previous month to 14.8%, the lowest level since at least February (see the nearby graph). April's commercial refi boom triggered by rock-bottom interest rates appears to have run its course.

- Valuation uses for loan renewals, modifications and extensions rose 1.3% for a third month in a row – also to at least a five-month high at 40.2%. While renewals predominated as usual in this category, we observed an uptick in loan modifications. Many bankers anticipate loan mods will accelerate for a wide variety of small-balance loans with expiring deferments beginning in Q4 and beyond.

- Orders for loan/credit reviews and portfolio monitoring jumped 3.2% to 17.1%, similarly a new high since February. These valuation uses are consistent with heightened measures generally by banks to anticipate and possibly reserve for further debt problems in the portfolio.

- Purchase and other new loans normalized at 25.4% with a rebound of 1.2% from June.

This report re-affirms that clouds are thickening over Main Street enterprises. The vulnerability of small businesses and property owners is echoed in the July survey of small business owners by the National Federation of Independent Businesses. For instance, the NFIB's overall Optimism Index hit a five-year low as owners’ positive outlook for business expansion as well as their sales expectations shriveled to the lowest percentages since 2016.

Clearly, the impact of COVID-19 on small businesses is disproportionate and devastating, with high risk of more closures considering their fragile financial profiles and the substantial macroeconomic uncertainty. Most any road to recovery for small businesses will take more time relative to larger companies if the 2008 recession is any guide.1

The federal government must take immediate steps to help shore up small businesses, so they have a chance of clawing their way back to health.

Randy Fuchs

Randy Fuchs