Many participants in the commercial real estate transaction market are seeking the proverbial light at the end of the tunnel knowing full well, though, that its appearance might signal instead something more ominous approaching. After all, a wall of worry still persists as the market copes with a big overhang of loan maturities, lingering high debt costs, and slumping asset valuations.

Of course, no one really knows how this will actually play out. Prognostications are all over the map, are often rendered with too broad a brush, and sometimes are inherently biased by the would-be seer’s investment focus (e.g., eager distressed debt funds). Better are the more nuanced considerations, for example those that extrapolate from operating fundamentals, demand trends, sector- and subsector-specific asset price changes and loan delinquency rates, etc., which tend to be more insightful and useful.

×

![]()

When looking back over 2023 and the fog that persists, one thing is clear: the small-cap CRE market remains a beacon of relative stability. For instance, we previously reported that this domain’s occupier fundamentals closed out last year in strong fashion (with the exception of a pullback in the industrial sector). Additionally, in a special Boxwood paired valuation study over the past two years, we found that there was low downside risk to asset valuations associated with small-cap properties.

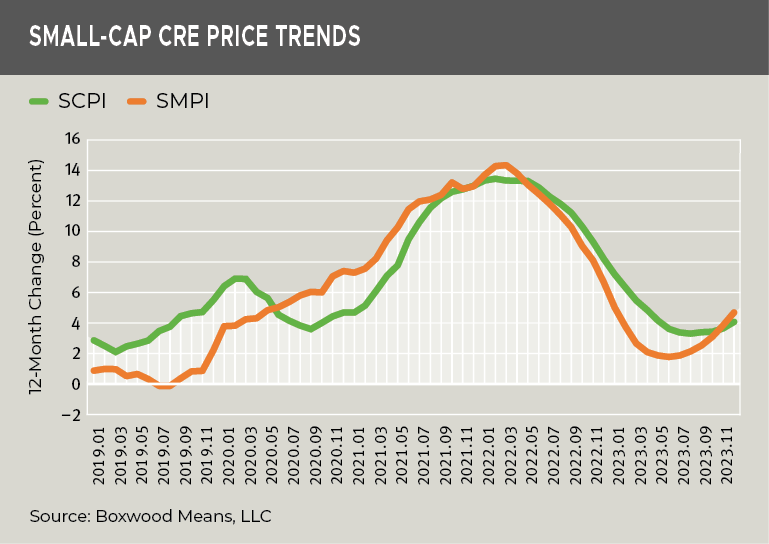

And we can now report that despite slumping sales transaction volume, small-cap CRE asset prices eked out gains rather than losses last year.

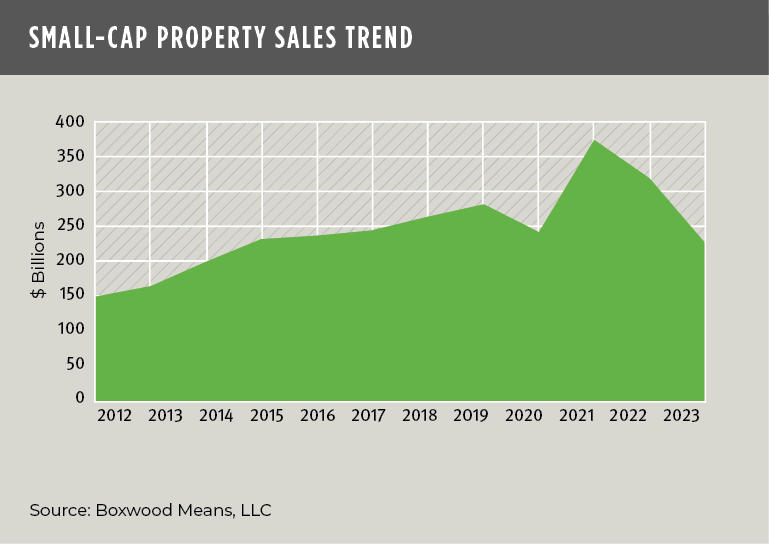

As the first graph shows, small-cap CRE sales volume fell nearly 30% to $226 billion YOY and a hefty 40% from its 2021 peak of $373 billion concurrent with mounting market uncertainties, high debt costs, and buyer-seller discord on prices. This weakened sales trend squares with the large-cap CRE market where MSCI reported that deal volume plummeted 51% in 2023 and represented the biggest annual drop-off since 2009.

However, the large- and small-cap domains parted ways when it came to property prices last year. MSCI indicated that CRE prices for principally larger properties fell 5.9% on average during 2023 led by a huge 16.1% loss in the office sector, followed by an 8.4% decline in multifamily. By contrast, Boxwood’s Small Commercial Price Index (SCPI) rose 4.2% last year, and similarly, our Small Multifamily Price Index (SMPI) increased by 4.9%. (See the nearby graph.)

×

![]()

These disparities remind us that the well-being of small commercial and multifamily assets and markets is, to a great degree, unruffled by the often-adverse consequences of large-scale shifts in institutional real estate equity investing and debt financing and, for that matter, the downsizings, staff layoffs, and financial engineering of national firms and large tenants that occupy premier properties of all kinds.

Instead, small-cap CRE reflects the steady pulse of the local neighborhood and its diverse collection of Main Street businesses. Main Street’s staying power is not without episodes of uncertainty, volatility, or business closings. Yet, with investments of sweat equity and life savings typically at stake, small business owners and small private investors have an uncommon will to survive and thrive.

This deep-seated, entrepreneurial spirit and strength materialized on Main Street and for small-cap CRE once again during 2023.

Randy Fuchs

Randy Fuchs