With the specter of a retail apocalypse diminished by a leveling off of online sales, the attractiveness of certain brick and mortar retail segments has revived and intensified. Frankly, a strong investment thesis for small neighborhood, community, and strip centers has been hiding in plain sight for years. But these somewhat ordinary small cap retail assets have lacked the panache associated with lavish, high-end retail and upscale boutiques – and the promise of premium sales per square foot – to otherwise appeal to many lenders and investors in a big way.

Yet what small cap retail may lack in sizzle is more than offset by their essential role in satisfying the routine, everyday needs of local shoppers. And now, as hybrid models allow employees to work from home a couple of days a week, neighborhood centers, local stores, and restaurants situated in leafy residential areas are riding a wave of increased consumer traffic. Furthermore, many retail businesses located in CBDs got the memo and are thus moving to the suburbs.

Also, favorable U.S. economic tailwinds are increasing the general attractiveness of the retail sector in particular. Employment growth slowed in June, but the numbers were still strong enough to keep unemployment at an historically low level. Noteworthy, too, is the fact that inflation has cooled tremendously of late – easing to 3.0% from a peak of 9.1% for the 12 months ending June according to the BLS. These trends have promoted wage growth above the rate of inflation for the first time in two years, and that has translated into more purchasing power for consumers. As a result, retail sales have continued to rise with “core” retail sales (excluding items such as autos, gasoline, building materials and food services) primarily driving healthy consumer spending.

Amidst these fresh signs that retail sales are on the rise, small cap retail has flourished despite the rising interest rates. Boxwood’s analysis of Q2 CoStar occupancy data involving small retail buildings under 50,000 sq. ft. includes the following highlights:

×

![]()

-

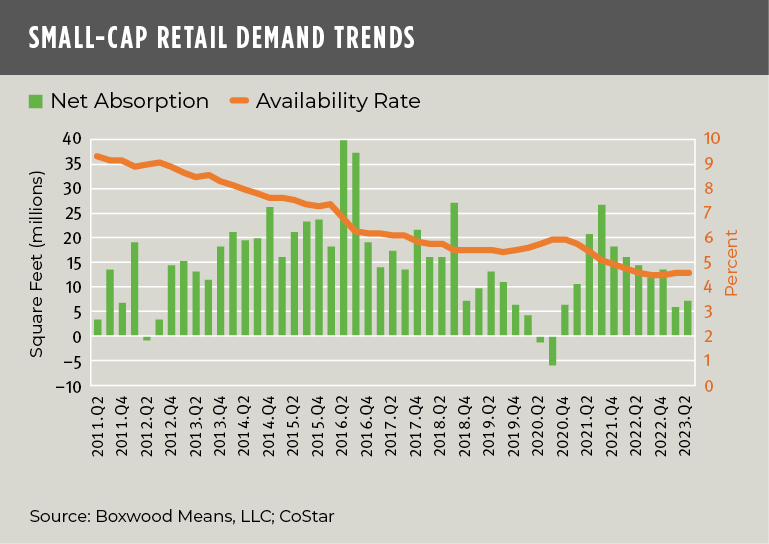

Tenant demand picked up. The string of positive net absorption stretched to 11 quarters in a row dating from the pandemic’s onset (see the nearby graph). While the 6.9 million sq. ft. of Q2 net occupancy gains declined 51% compared with last year, demand rose 21% sequentially with increased in-store shopping by consumers. (Of note, while small cap retail has posted sustained gains, both the small cap industrial and office sectors suffered net occupancy losses in each of the first two quarters of this year.)

-

Space availabilities hover at an all-time low. Steady demand coupled with only modest retail building deliveries kept the national availability rate at a record low of 4.5% for the fifth consecutive quarter and 250 bps below the long-term average. Sublease space, at 0.2% of total U.S. small cap retail inventory, barely budged suggesting that small retailers are in relatively good shape.

×

![]()

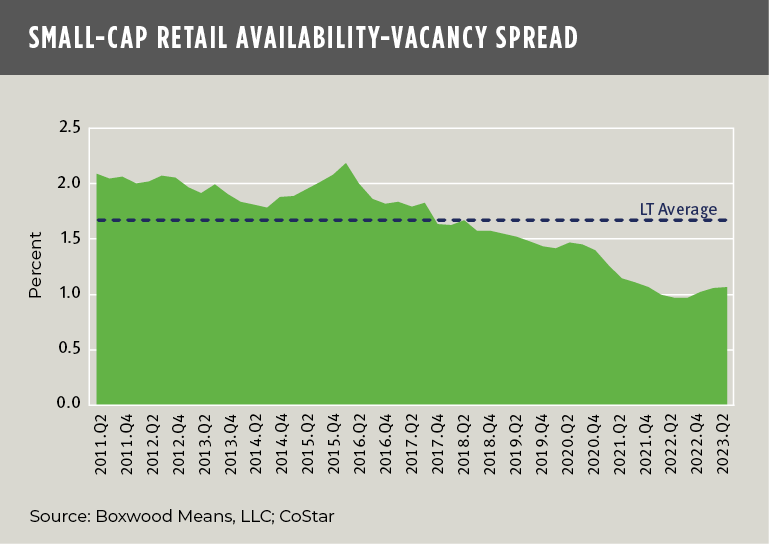

Direct space also remained tight. The national vacancy rate, which excludes marketable sublet space or rental units with expiring leases, totaled 3.5% -- also a nadir – and 200 bps under the historical average. As shown in the next graph, the very thin spread of 110 bps between the total national availability and vacancy rates indicates affirmatively to lenders and investors that small cap retail occupier trends have strong, positive momentum.

Asking rents advanced. As occupancies have tightened, rents grew at a healthy 2.2% clip through June and 3.9% YOY. While this annualized growth has slowed over the last few quarters, the annual gains are in line with the advances immediately prior to the pandemic.

As an asset group, retail properties were supposed to be largely on their death march by now due to widespread e-commerce disruptions. But let’s consign that narrative to the history books. Low space availabilities and steady rent growth are bullish signs for small cap retail property values. Small neighborhood and suburban retail centers have finally emerged as prized assets, and lenders and investors might take notice.

Randy Fuchs

Randy Fuchs