The small-cap commercial real estate (CRE) market is showing encouraging signs of recovery, even as uncertainty around interest rates and macro conditions temper investor enthusiasm. Recent trends in cap rates and transaction volumes across the four main property types suggest that the worst of the CRE valuation reset may be behind us, and market liquidity is cautiously returning.

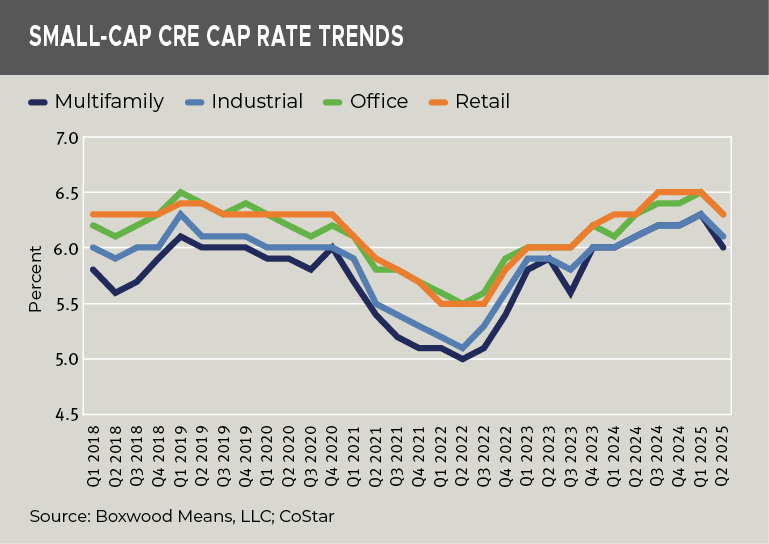

Cap Rate Trends Show Stabilization

Cap rates, which rose sharply across all asset classes from 2022 through early 2025, have begun to level off — and even dipped slightly in Q2 2025. See the nearby graph and table below.

×

![]()

| Property Type |

Peak Cap Rate |

Q2 2025 Cap Rate |

Qtr. Change |

YOY Change |

| Multifamily |

6.3% |

6.0% |

-0.3% |

-0.1% |

| Industrial |

6.3% |

6.1% |

-0.2% |

0.0% |

| Office |

6.5% |

6.3% |

-0.2% |

0.0% |

| Retail |

6.5% |

6.3% |

-0.2% |

0.0% |

While cap rates are still roughly 80–130 basis points above their 2022 lows, the recent flattening suggests pricing stability and improved alignment between buyer and seller expectations. This trend is especially notable in multifamily and industrial sectors, where fundamentals remain relatively solid.

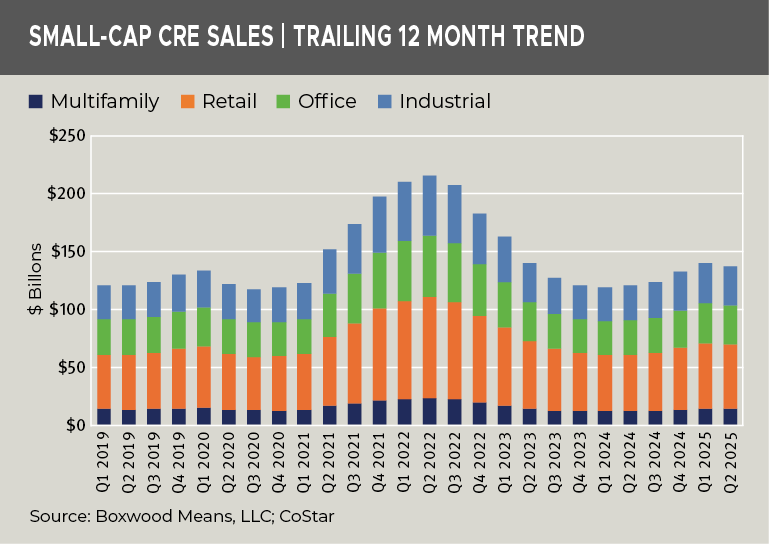

Transaction Volume Points to Gradual Rebound

After a deep contraction in 2023, quarterly sales volume has posted double-digit year-over-year gains. Though deal volume declined slightly in Q2, the trend line over the last four quarters suggests a cautious return of capital to the market. See the nearby graph and table below.

×

![]()

| Property Type |

Q2 2025 Volume ($B) |

Qtr. Change |

YOY Change |

| Multifamily |

$14.6 |

-1.0% |

+14.8% |

| Retail |

$55.2 |

-2.1% |

+13.8% |

| Office |

$33.6 |

-1.8% |

+14.1% |

| Industrial |

$34.0 |

-2.4% |

+12.4% |

| Total |

$137.3 |

-2.0% |

+13.6% |

Retail remains the most liquid sector by dollar volume, while multifamily and industrial are showing notable momentum off their recent lows. Even office — long the underperformer — has seen a moderate pickup in activity, likely fueled by price adjustments and opportunistic investors.

Takeaways: Where the Market Is Headed

-

Recovery in motion

The rebound in deal volume and cap rate stability indicate that the market is past its cyclical bottom, though gains may remain uneven across property types and regions.

-

More predictable pricing environment

Current sales investment trends suggest that buyers and sellers are getting on the same page.

-

Multifamily and industrial lead the way

These sectors remain favored due to demographic tailwinds and steady user demand, even amid tighter credit conditions.

-

Office: still challenged, but active

Activity in the office sector remains subdued, but price discovery and distress sales are beginning to attract capital.

-

Retail: surprisingly resilient

Retail volumes have remained strong in this small-cap segment where tenant diversity and essential services mitigate risk.

Final Thought

The small-cap CRE market appears to be pivoting from repricing to repositioning. While we may not see a full return to the 2021 frothy level, the Q2 data shows a healthier, more disciplined market emerging — one driven by fundamentals, creative capital, and local-market expertise.

Randy Fuchs

Randy Fuchs