The small-cap CRE market showed greater stability, if not positive momentum, during the third quarter. Highlights of our analysis of sales transactions and cap rates for properties under $5 million in value are outlined below.

Sales Transaction Market Turns the Corner

×

![]()

-

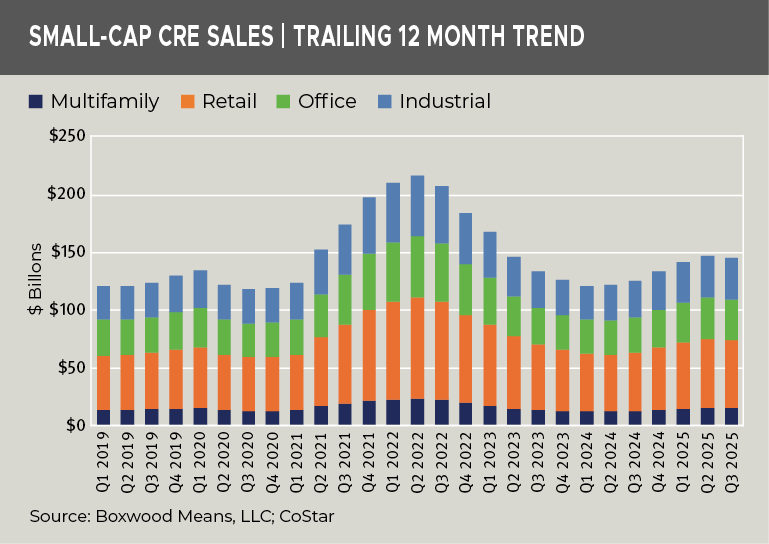

After an unprecedented boom-to-bust cycle, small-cap CRE transaction activity is entering a period of normalization. The market has regained more than half of the volume lost since the 2022 peak, aided by modestly lower interest rates and improved clarity around asset pricing. While sales remain below prior highs, the trajectory in 2025 suggests the market has transitioned from correction to gradual recovery, led by multifamily and industrial assets.

-

During 2024, total small-cap property sales hovered around $120-130 billion per quarter—roughly back to pre-pandemic norms. Momentum has improved this year, with total volume reaching nearly $148 billion by Q2 before easing slightly to $146 billion in Q3. Year-over-year gains remain positive (+16%), signaling renewed liquidity and selective investor re-entry across sectors. See the nearby graph.

Sector highlights include:

-

Multifamily has rebounded most dramatically with Q3 volume up nearly 19% YOY, benefiting from demographic tailwinds and sustaining robust rental demand.

-

Retail and office sales show similar 15-17% annual growth, though both remain roughly one-third below peak levels.

-

Industrial remains the most resilient sector overall, with the smallest decline from peak (-31%) due in part to tenant needs for logistics, small-bay and light industrial space.

Cap Rates Plateau and Edge Downward

×

![]()

-

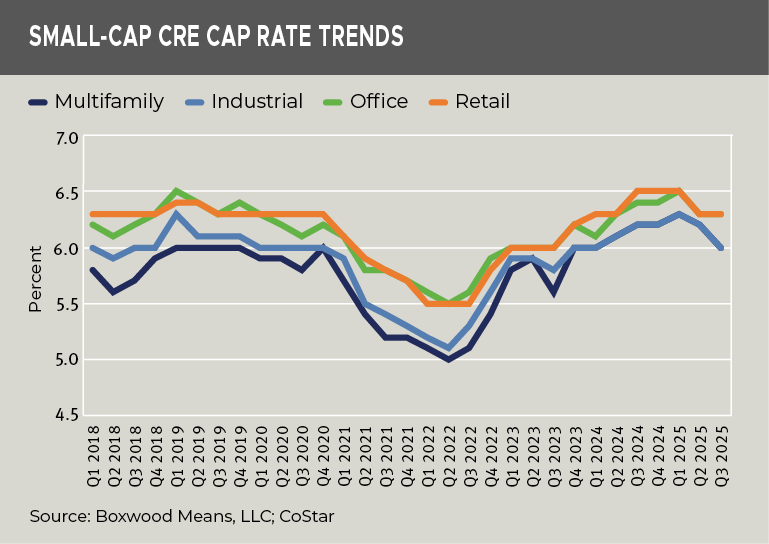

Cap rates for small commercial and multifamily assets have risen by 100 basis points from their post-pandemic lows but have stabilized within a narrow 6.0-6.5% range across sectors. See the nearby graph.

-

The modest quarterly and YOY declines in Q3, i.e., down 20 bps for most property types, suggest the market may have reached equilibrium. Multifamily and industrial assets - still the tightest - benefit from solid fundamentals and improving financing conditions, while office and retail remain slighter higher, reflecting residual risk premiums.

Takeaways and Implications

-

The stabilization of cap rates suggests valuations have largely adjusted to the higher-rate regime. At current levels, cap rates now translate into better risk-adjusted returns for buyers with access to capital. In the small-cap space where private investors dominate, this environment favors cash-rich or lightly leveraged buyers who can capitalize on reduced competition and motivated sellers.

-

Stabilized assets in secondary markets, particularly in the multifamily and industrial sectors, are likely to see the strongest recovery in pricing and liquidity. Yet, don't count out small neighborhood and strip centers that are very attractive based on a diverse tenant mix, high occupancy rates, and limited new supply.

-

Lenders are likely to remain conservative, favoring seasoned operators, strong tenancy, and assets with resilient cash flow, while selectively expanding credit as interest rate expectations further moderate. Refinancing risk for borrowers will persist for properties acquired at low cap rates in 2021-2022, but stabilized pricing offers a pathway for deal activity to normalize.

-

Overall, the combination of steady transaction volume, improved yields, slowing rate pressure, and clearer valuation benchmarks sets the stage for continued recovery in small-cap CRE investment and lending through 2026.

Randy Fuchs

Randy Fuchs