Multifamily assets have a distinguished record of producing outsized returns for investors over a decade or more. That positive legacy has been tarnished a bit by a sharp price decline suffered sector-wide this year. But there is one exception to this general pullback: braced by chronic shortages of new supply, prices for small cap multifamily properties have carved out a singular trajectory by staying aloft.

A crush of apartment supply largely explains the notable reversal in the nation’s overall apartment prices. Renter demand has been overwhelmed by the biggest surge in apartment construction in more than 50 years. According to RealPage, over 461,000 units are targeted for completion this year with another 670,000 in 2024 – in sharp contrast with annual deliveries that typically average about 300,000 units and haven’t exceeded 400,000 in roughly 40 years.

A similar building oversupply is estimated by CoStar. As a result, CoStar indicated that the Q3 national apartment vacancy rate rose 200 bps to 7.4% since hitting an all-time low two years ago. Meanwhile, annual rent growth, at 0.6%, has continued to decelerate. Of course, the flip side to these market conditions is good news for renters because apartment owners are increasingly offering tenant concessions to shore up occupancies especially in newer complexes.

It also follows from these vulnerable rental trends that multifamily prices would come under pressure. And, so, prices among principally large apartments recorded their biggest 12-month setback among the four major property types with a decline of 12.8% through September according to the RCA/MSCI Apartment Index1. This stinging loss overshadows an otherwise stellar price performance over the past decade including the sector’s 16.7% increase over three years along with 5- and 10-year returns of 33.1% and 121.4%, respectively.

×

![]()

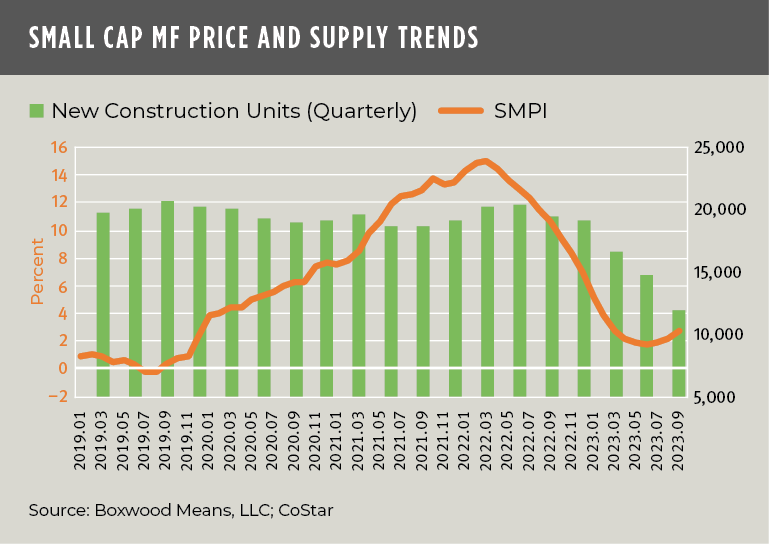

However, small multifamily owners and investors have essentially sidestepped this year’s reversal of fortune within the greater apartment market. Whereas an overabundance of supply dogs larger apartments, scarcity props up the smaller domain. The Q3 national vacancy rate for small multifamily rentals was 4.7%, 50 bps higher than a year earlier but still below its long-term average according to Boxwood’s analysis of CoStar data2. And, though both small cap tenant demand and a 1.7% annual effective rent growth rate are flagging of late, it’s not due to a lot of new supply coming online. To the contrary, at a steady, rolling four-quarter average between 12,000-13,000 units, annual small cap apartment deliveries represent a mere fraction of total deliveries for the sector as a whole. As shown in the nearby graph, the Q3 new construction pipeline of roughly 12,000 units is similarly weak, well below the five-year quarterly average of about 18,000 and, importantly, underscores the long-run difficulties the industry faces in building affordable multifamily housing at scale.3

Principally due to these dramatic differences in fundamentals highlighted by tight supply, small cap multifamily prices have charted a distinct path this year (refer again to the graph). In contrast with RCA’s low-teens price decline for the apartment market at large, Boxwood’s Small Multifamily Price Index (SMPI) gained 2.7% over 12 months through September, a noteworthy, albeit modest result in light of market-wide commercial real estate headwinds. Moreover, SMPI has produced 3- and 5-year returns of 28.4% and 36.9%, respectively, that have soundly outperformed RCA’s Apartment CPPI over the same time periods and, with its 111.3% gain over 10 years, SMPI nearly competes with the latter’s longer-term price growth as well.

Despite these uncertain times, it's no wonder then there’s no dearth of lenders and investors scouring the land for deals in this unique small cap multifamily arena.

Randy Fuchs

Randy Fuchs