×

![]()

Boxwood's property valuation assignments indicate that client lenders remained preoccupied during May with specialized lending activities resulting from the pandemic. Given the nature of current workloads, a return to normal lending routines may be further delayed.

The Fed's massive Paycheck Protection Program (PPP), under which banks and nonbank lenders doled out over 4 million loans with a total loan value exceeding $500 billion as of early June, diverted the daily habits of large numbers of lending staff at client institutions this spring. Furthermore, since the regulatory agencies relaxed potential criticism of financial institutions that prudently mitigate credit risk through proactive engagement with borrowers, most lenders ended up issuing lots of temporary deferrals because of the outbreak.

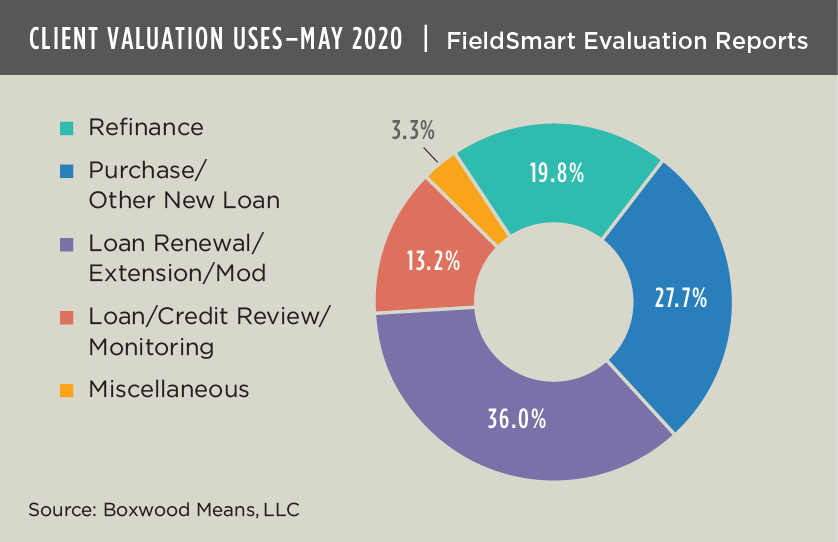

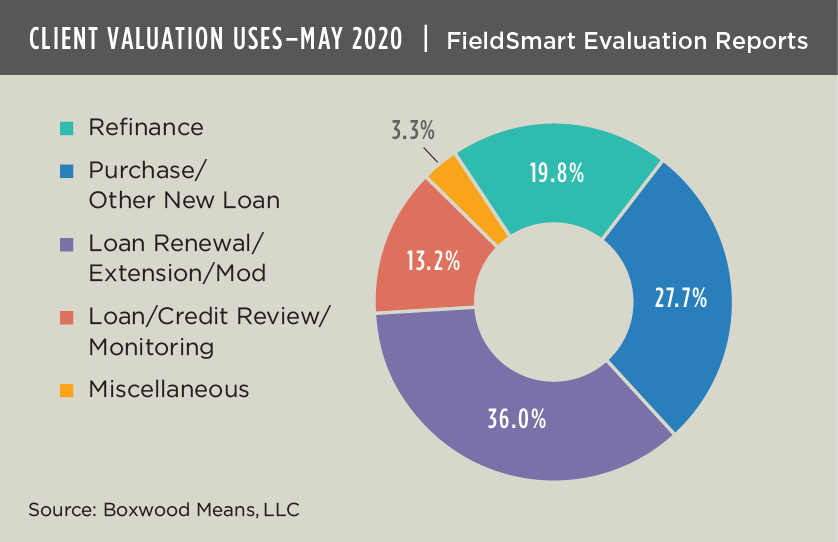

In fact, client uses of Boxwood's FieldSmart Evaluations during May showed a sizable uptick in loan renewals, modifications and other non-financial transactions. Key takeaways from our analysis of last month's procurement data include:

- Orders supporting loan renewals, modifications and extensions rebounded 7.0% to 36.0% of all assignments as forbearance and modification-related decisions accelerated.

- Loan refinance activity declined 6.3% from April to a 19.8% share of total orders. It’s likely that a crush of refinance deals in the pipeline may have closed during April with interest rates at historic lows. However, refi volume slid during May because of challenges and disruptions to new business development following work from home and social distancing measures.

- Purchase and other new loans marginally decreased during the month, too, by 1.6% to a 27.7% share but was on par with March activity. By contrast, during more buoyant times like last fall valuation assignments related to purchase and other new loans accounted for nearly 35% of all orders.

- Loan/credit review and portfolio monitoring eased 2.0% to 13.2% but remained at substantially higher levels of activity than two months earlier because of lender concerns over heightened credit risk.

Also, in the Miscellaneous category we found a slight uptick in problematic loans, i.e., orders involving loans in pre-foreclosure and workout status. The number of problem loans was relatively small, but the order volume may soon increase: that is because delinquent loans that have been artificially suppressed through forbearance and/or with the help of the government’s PPP funding may be further impaired as the recession unfolds.

Increasingly, it appears that CRE lending and credit staff will focus more intensively on monitoring portfolio risk and the institution’s overall safety and soundness.

Randy Fuchs

Randy Fuchs