Introduction

Much attention is paid these days to plummeting CRE asset valuations particularly among institutional-quality office buildings in downtown settings. Transaction-based valuations of some office properties indicate price reductions of as much as 30-40% from peak levels a couple of years ago with somewhat narrower price declines among multifamily and retail sectors. Property appraisals on some institutional properties have also shown devaluations though not to the same degree reflected by sales prices.

A burning question for lenders and investors though is to what degree have these losses spilled over to the less visible but massive, small-cap CRE domain. After all, by our estimates this realm accounts for roughly 55% of the total U.S. inventory of non-owner-occupied (multi-tenant) office, industrial, and retail properties that primarily house small employers and Main Street businesses.

The fact is that the small-cap CRE space is often overlooked because many observers assume that this domain is small or insignificant, and/or that it chiefly mirrors trends in the large-cap or institutional market. This is simply not the case. First, Boxwood’s research has consistently highlighted the superior performance of this smaller domain in terms of occupier fundamentals including unique supply and demand trends, e.g., historically low vacancy rates, that support income growth and stout asset valuations. Second, small-cap CRE prices have capitalized on these fundamentals by evidence of annualized single-digit price growth recorded by both Boxwood’s national Small Commercial Price Index (SCPI) and Small Multifamily Price Index (SMPI). By contrast, large-cap commercial and multifamily prices have plunged over the past 12 months; hence, the difference in price performance between the two domains cannot be understated.

Study Scope

To confirm this outperformance in asset prices and to further illuminate trends in the small CRE property market generally, we studied changes in Boxwood’s asset valuations over the past two years with a couple of objectives in mind:

-

1. To ascertain the amount of movement of, or pressure on small-cap CRE valuations in light of prevailing market conditions.

-

2. To further validate Boxwood’s unique, “whole-market” small-cap price indices results using an alternative source of CRE asset valuation data.

-

3. To offer clients and the public some insight into the magnitude of potential valuation risk associated with small-cap collateral that is held in client loan portfolios.

In conducting the study, we assembled 450 commercial evaluations and appraisals (henceforth “appraisals”) on subject properties in our database on which our in-house staff of analysts and appraisers performed repeat valuations between 2022-2023 during the normal course of business supporting lender clients. The mix of properties, across a total of 40 states, principally included: Office (29%); Retail (27%); Industrial (21%); Multifamily (7%); and Special Purpose (7%).

Study Results

Key findings of our paired valuations study include:

-

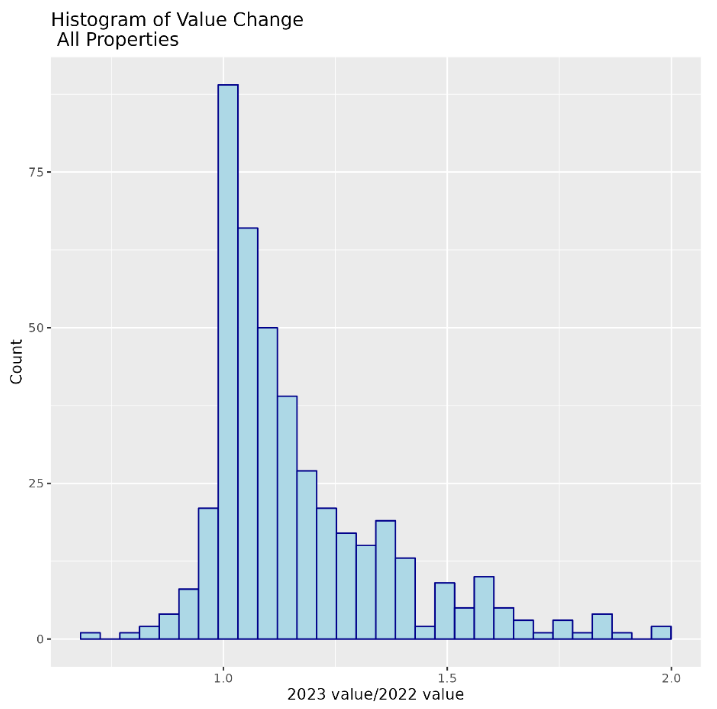

The median change in value across all property types was +9%. The industrial sector exhibited the greatest average increase in values at 20%, followed by multifamily (17%), office (9%), special purpose (8%), and retail (7%). Given robust investor appeal for industrial and multifamily assets generally, and also specifically to the small-cap domain due to continuing disequilibrium in supply-demand dynamics, the leadership in growth by these two sectors is altogether unsurprising. (See the nearby graph of the aggregate valuation changes across all property types where, e.g., 1.0 on the X-axis equals no change YOY and 1.5 means an increase of 50%.)

×

![]()

-

Most of the assets across all property types received a higher repeat value.One-half (50%) of the 2023 appraisals were within +/- 10% of their first valuation, with 48% of the second valuations ending up above 10%. Just 2% were pegged at a lower valuation the second time around.

-

When stratifying the valuations into three separate dollar valuation tiers, only retail exhibited any meaningful distinction among the property types.That is, there was a 12% increase in median retail valuations for assets under $500,000 while appraisals within the bigger two brackets ($500,000-$1,000,000 and $1,000,000+) appreciated at a lower rate and close to this sector’s median increase (7%). We surmise that the attributes of these smaller retail buildings such as special location, business type, and/or facility use (e.g., retail condo) contributed to the higher valuations relative to the other tiers.

-

Though some valuations, out of necessity, included older sales comps, the impact on the appraisals appears to have been relatively minor. Appraised values generally tend to lag changes in prices/valuations in both rising and falling markets especially when sales transactions are relatively scarce. However, the study results show that 50% of the sales comps used by Boxwood’s appraisers were less than 12 months old, including roughly 25% of that total that traded within six months of the valuation report date. Another 25% of the comps were 18 months or older. Even with adjustments for timing and market conditions especially regarding the older comps, we might expect that comps’ age exerted some modest influence on the study’s higher repeat valuations. But it was likely not a major determinant particularly when the appraisal also included the income approach.

Conclusion

Our major takeaway from this study is that the paired valuation results are directionally consistent with the recent increases in Boxwood’s small CRE price indices and also reflect the continually strong occupier fundamentals within the space. The small-cap property market has historically proven, cycle after cycle, to be more resilient, less volatile, and distinctive compared with the large-cap or institutional market. So, it’s not surprising to us that the repeat asset valuations on small-cap CRE assets in 2023 were higher than our initial appraisals in 2022, and that our findings differed markedly from the (downward) trajectory of prices and valuations in the larger property market.

A growing number of financial institutions, particularly national and regional banks, are now saddled with rising CRE loan delinquency and NPL issues related primarily to large investment grade, non-owner-occupied properties. It may be comforting that, at the very least, the study’s results suggest that collateral values for small-balance CRE loans held in lender portfolios may be holding up relatively well despite the industry’s overall apprehension about where CRE asset values are headed.

Randy Fuchs

Randy Fuchs