×

![]()

As the coronavirus pandemic wreaks havoc on businesses and public life writ large, its impact, as well as the demands of the federal Paycheck Protection Program (PPP), have disrupted the daily tasks and operations of Boxwood’s bank clients in credit and appraisal departments nationwide.

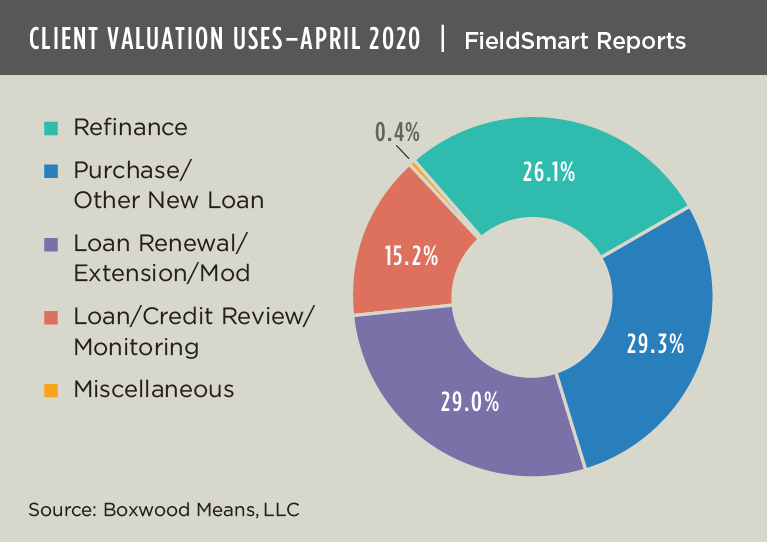

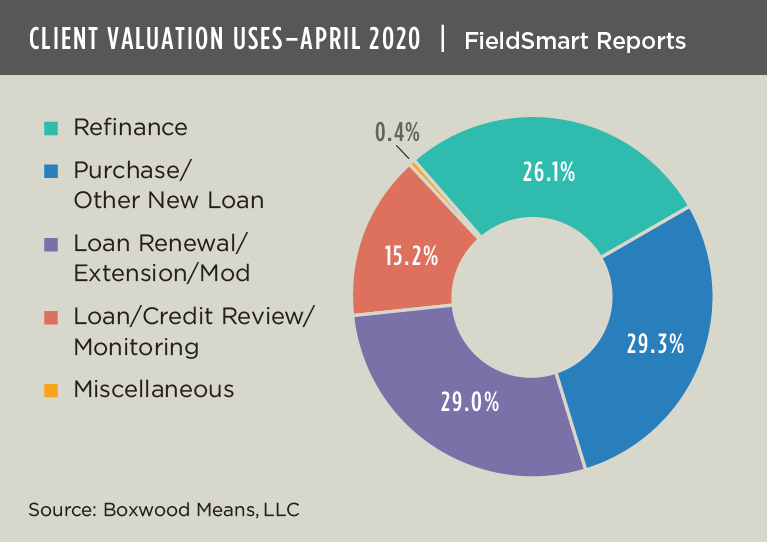

With borrowers and small businesses at increasing risk of nonpayment on their mortgages, Boxwood's clients have necessarily ratcheted up FieldSmart Evaluations for the purposes of credit reviews and monitoring. (See the nearby graph.) Yet, there have been other noteworthy shifts in client uses of our evaluation reports compared with last month's report. Key takeaways from our analysis of April procurement data include:

Loan/credit review and portfolio monitoring activities jumped 7.2% during the month to 15.2% of all FieldSmart valuation uses with the intensified focus on borrower credit risk.

Loan renewals, modifications and extensions dropped 8.4% to 29.0% as the flood of PPP applications diverted staff resources from routine work. Also dampening bank’s emphasis on subsequent or non-financial transactions were new coronavirus-inspired federal rules allowing for extended forbearance on loan payments.

Loan refinance activity accelerated with mortgage rates hovering near all-time lows. FieldSmart Evaluations backing refinance loans rose 4.6% to a 26.1% share of all valuation reports.

Purchase and other new loans including lines of credit grew 1.3% to 29.3% of all orders as attractive interest rates motivated some buyers and, also, certain businesses attempted to shore up their finances in leaner times.

Considering the outbreak's dissolution of the longest CRE market expansion on record as recently reported in our Q1 blog piece, we might anticipate that further deterioration of CRE market conditions will compel commercial banks to further ramp up loan review and portfolio monitoring activities in the months ahead.

Randy Fuchs

Randy Fuchs