The credit quality of commercial and multifamily real estate (CRE) loans held by banks continued to deteriorate in the first quarter of 2025. It's a troubling picture, with delinquencies rising faster than banks can respond—raising concerns about the financial health of many institutions.

Here are the major findings based on Q1 2025 Call Report data from BankRegData, focused on bank-held multifamily (MFR) and non-owner-occupied (NOO) commercial real estate loans.

×

![]()

Delinquencies Are Climbing Rapidly

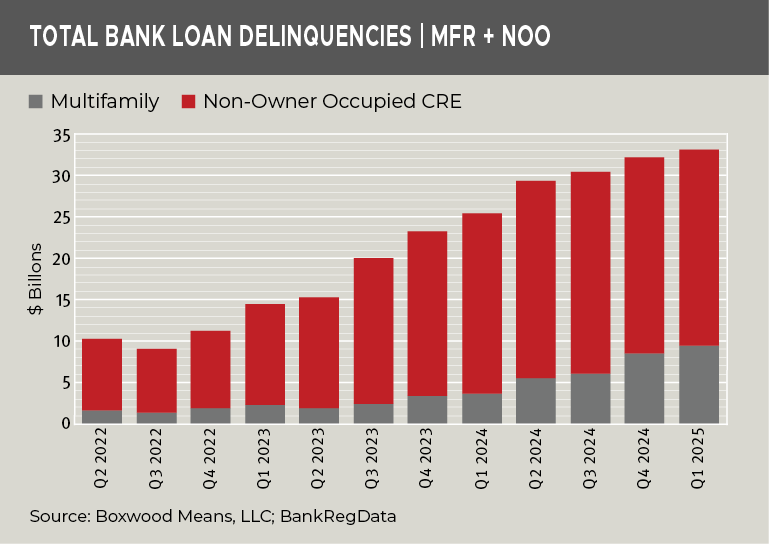

Delinquent loan balances for MFR and NOO properties surged by nearly $1 billion in Q1 and by 32.2% year-over-year, reaching a total of $33.09 billion – the highest level in 13 years, dating back to the post-Great Financial Crisis period. See the nearby graph.

-

MFR delinquencies, while only 30% of the total, are growing much faster. They rose to $9.4 billion, a 155.7% YOY increase, equating to 1.49% of all MFR loans.

-

NOO CRE delinquencies now stand at $23.7 billion, or 2.04% of all NOO loans—up $7.7 billion or 30.2% YOY.

Banks Are Ramping Up Modifications—But Not Fast Enough

×

![]()

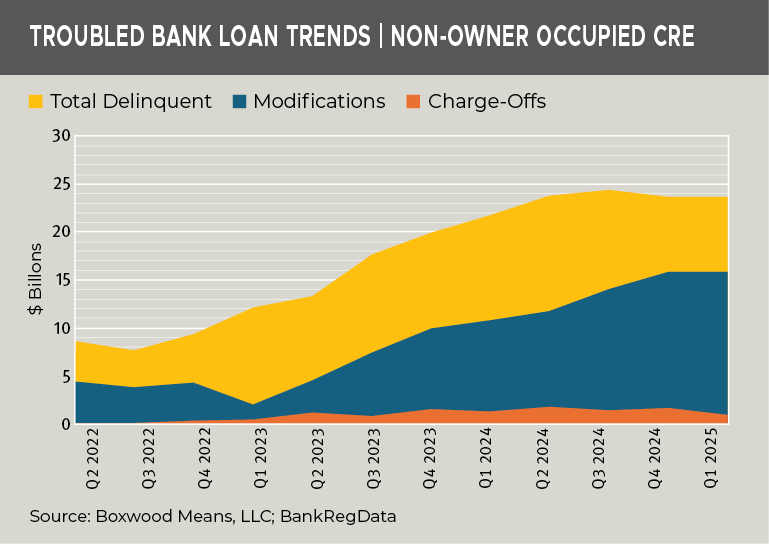

Facing rising delinquencies, banks are stepping up efforts to modify troubled loans, particularly in the NOO segment.

-

NOO modifications totaled $15.9 billion in Q1 – flat from the previous quarter but up $5.2 billion or 48.2% YOY and now represent 1.37% of the $1.16 trillion in NOO loans.

-

Despite rising distress, NOO loan charge-offs were relatively modest at $954.3 million (or 0.33%)—a 23-basis-point drop from the prior quarter. This marks the fifth consecutive quarter of declining charge-offs, suggesting banks are reluctant to take losses. See the nearby graph comparing the problem NOO loan trends.

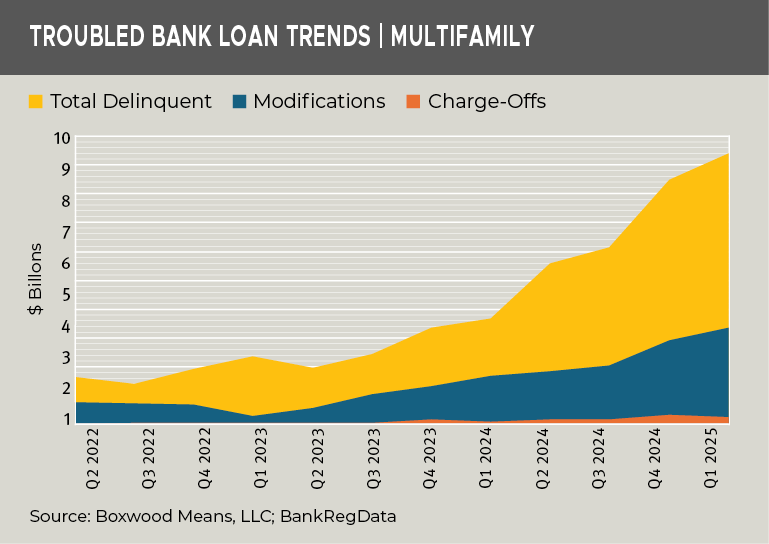

By contrast, mitigation efforts for multifamily loans are falling behind:

×

![]()

-

Banks modified $3.4 billion in MFR loans (or 0.53% of the $634.5 billion total)—up $1.7 billion YOY, but still well behind the 50% faster growth in delinquencies.

-

MFR charge-offs totaled $231.5 million (0.15% of MFR loans), a sharp 186.4% increase YOY, but still small relative to total delinquency levels. See the nearby graph of problem MFR loan trends.

Key Takeaways

-

Credit quality is worsening due to rising costs, tighter capital markets, and softening property fundamentals.

-

Banks are increasing loan modifications, but not fast enough to keep up with the surge in delinquencies.

-

The gap between delinquent and modified loans is widening, suggesting a growing backlog of unresolved credit risk on bank balance sheets.

-

Charge-offs remain low in absolute terms, as banks try and buy time via modifications and workouts instead of recognizing losses.

If economic and financial conditions don’t improve soon, the current pace of mitigation may fall short – raising the risk of higher losses ahead.

Randy Fuchs

Randy Fuchs