Many commercial banks have a history of pulling in the reins on CRE lending when macroeconomic conditions deteriorate, especially when a recession looms or makes landfall. Evidence of a bank slowdown is afoot, and SBA lenders are ready to pick up the slack.

High interest rates and uncertain economic conditions are major reasons that lenders are now pulling back. Loan applications have declined and lots of deals are failing to close because of tightened underwriting. No doubt we’re entering a riskier stage of the real estate cycle.

That assessment, and concerns over rising macroeconomic instability are also behind the FDIC’s announcement in a report last week of a new round of CRE credit testing and review of risk management processes, after banks have steadily increased their lending exposure in the space to $2.7 trillion at the end of last year.

All of which may lead to expanded opportunities for SBA lenders as conventional banking lenders grow more risk averse. As an SBA lender was recently quoted in an American Banker article, “Every time we have a cycle like this, SBA booms.”

×

![]()

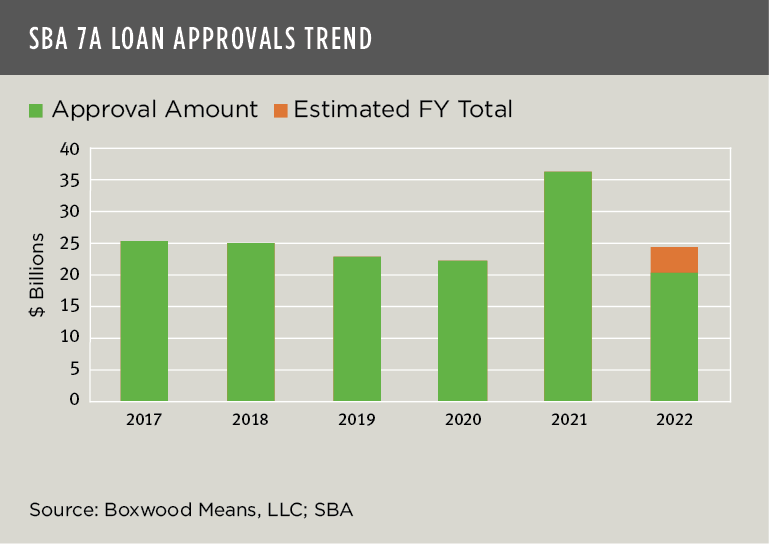

So far, it’s been a solid year for SBA 7(a) lenders.1 In the current fiscal year between October 2021 through July, SBA reported guarantees of $20.5 billion including nearly 38,200 7(a) loans2. If we estimate total approvals for the full fiscal year, the annual total will approach $25 billion, on par with recent years with the exception of 2021. Last year 7(a) lenders received a big boost from the Cares Act that super-charged capital access for Main Street businesses (see the nearby graph).

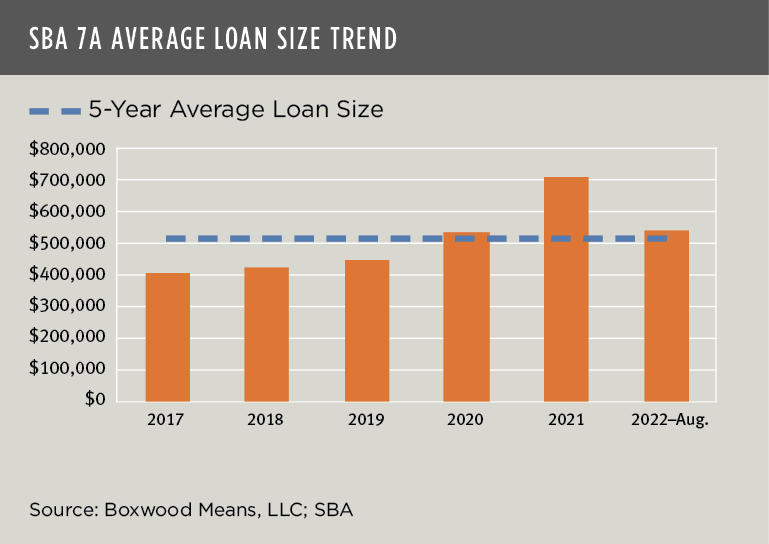

What is especially notable about this 7(a)-loan activity is the consistently modest, average size of these loans (see the next graph). Despite a 31% increase in average loan size since 2017, the average approval amount over the five-year period was just $508,000. And while, for example, only 16% of FY2022 dollar amounts have been slotted for 7(a) loans under $350,000, this dollar threshold accounted for a whopping 67% of the total number of approved loans.

×

![]()

These smaller 7(a) loans are obviously where most of the action is, and it’s no surprise that over the past several years lenders have increasingly made capital investments and/or sealed fintech partnerships to streamline their small business lending and credit processes to maximize efficiencies, lower costs to borrowers, and close more loans.

Though automating these processes holds great promise in simplifying 7(a) lending for Main Street businesses, the inescapable reliance of lenders on third-party due diligence reports – the conveyance of which is often hampered by delays and added expense – remains a pain point for lenders and borrowers alike.

In particular, third-party USPAP-compliant appraisals on 7(a) loans secured by commercial real estate embody the heightened risk to, and excessive cost of funding these loans, particularly smaller credits.

Yet where feasible and prudent, replacing appraisals with commercial evaluations can be a valuable component of lender strategies to optimize workflows for many small 7(a) loans backed by commercial real property. In fact, some of the largest nonbank SBA lenders take full advantage of the revised SOP 50 10 guidance3 that permits SBA lenders to use evaluations for CRE-secured loans under $500,000 consistent with the Interagency Appraisal and Evaluation Guidelines and when an appraisal is not required.

This opportunity to reduce appraisal costs and time to close has eluded a surprisingly large number of bank and nonbank SBA lenders even though the revised SBA policy became effective more than three years ago.

Of course, as the saying goes, “it’s better late than never.” If commercial banks continue to disengage from CRE lending this year, SBA 7(a) lenders that step up and satisfy the considerable number of small dollar-loan needs of Main Street businesses – and use evaluations when applicable – will further enhance their lending solutions for borrowers.

Randy Fuchs

Randy Fuchs