×

![]()

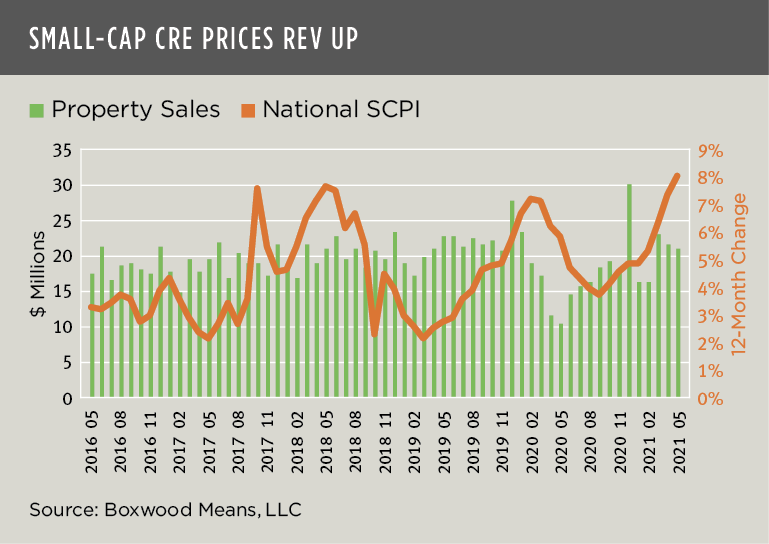

As U.S. GDP eclipsed its pre-pandemic high during second quarter, small commercial real estate prices rose at the fastest pace since 2007.

Boxwood’s national Small Commercial Price Index (SCPI) covering 160 metro areas advanced at an annual rate of 8.1% during May as small businesses and small-time CRE investors regained confidence in the economic expansion and converted their pent-up demand for asset trades. The last time property prices rose so swiftly was at the height of the CRE bull market in mid-2007. As of May, SCPI was 19% above the previous high-water mark that summer.

Sale volume has also quickly revved up. Unsurprisingly, sales transactions totaling $98 billion over the first five months of 2021 are up over 20% compared with last year. And though total sales volume was roughly flat compared with the healthier January-May period during 2019, aggregate sales in the latest three months were sizable and largely comparable to the sum over any previous three-month period on record. (See the nearby graph.)

The small multifamily sector continued to outclass the stellar price performance of small commercial properties mentioned above. Boxwood’s Small Multifamily Price Index (SMPI) that tracks 100 metro areas climbed by 9.9% in May, the best annual return in more than three years. The persistent imbalance between constrained affordable rental housing supply and heavy demand by small-time investors is perhaps the key driver behind SMPI’s lofty elevation at 65% above the previous peak in 2006.

Unlike the shocks inflicted on economic activity, the coronavirus didn’t interrupt but only slowed the pace of CRE investment growth. Based on this past resilience as well as improving rates of vaccination, it seems plausible that the rise of the delta variant will not significantly threaten the positive trajectory of most small-cap CRE sectors.

Randy Fuchs

Randy Fuchs