×

![]()

Small-cap CRE investment trend data increasingly reflect the impact of Main Street business layoffs and closures in the pandemic's wake.

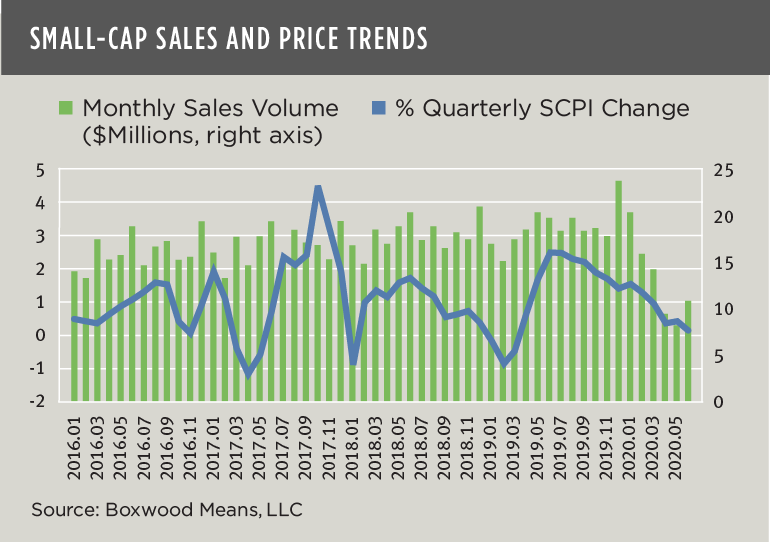

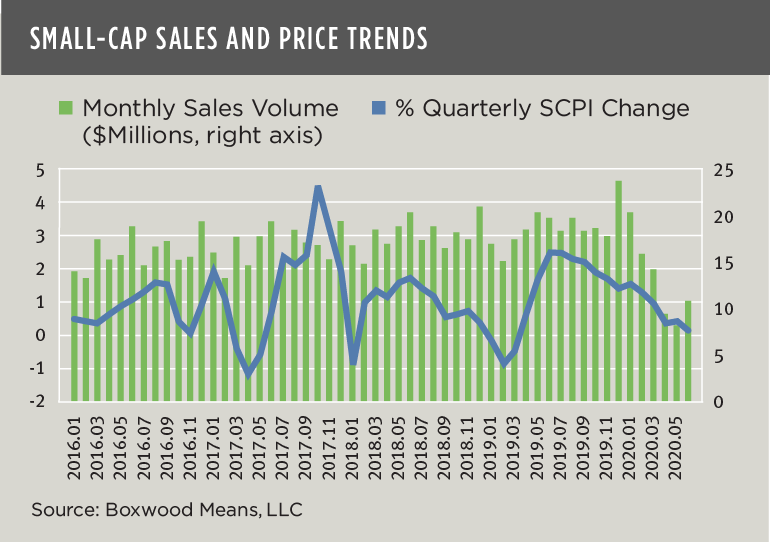

According to our latest available data, Boxwood's national Small Commercial Price Index (SCPI) dipped during June on a preliminary estimate basis by 20 basis points, the first decline in 16 months. While one month's decline does not predict a trend, SCPI’s negligible quarterly growth on a rolling basis from March through June – accentuating the longer sloping trend – is notable and syncs up with the damaging effects that COVID-19 has wrought on the small business economy during this period (see the nearby graph).

In addition, sales transaction volume has plummeted. The $11 billion in preliminary June sales involving assets valued under $5 million represented a 45% pullback YoY. Transaction volume YTD through June totaled $78 billion, off 27% from the same six-month period last year.

A similar plunge is sales transactions has occurred in the large-cap CRE market. Total sales activity for principal properties above $2.5 million dropped 65% YoY and by 28% for the first half of 2020 compared with 2019 according to data from Real Capital Analytics.

Despite very favorable interest rates for asset purchases, anecdotal information suggests that many buyers and sellers are largely in disagreement over property valuations considering CRE market and economic uncertainties. Clearly, questions remain over the viability of some sectors like hospitality because of low occupancy rates, as well as certain retail outlets that consumers have spurned in favor of online shopping. Moreover, the degree to which downtown office buildings will fully re-populate over time seems to be an open question resulting from lingering doubts about public health issues coupled with the success of employees working from home. For example, a recent survey by accounting firm PwC indicated that, while CEOs are not planning on abandoning their office facilities, a third of the executives reported that they will need less space in the future because of remote work.

The COVID-19 era has accelerated trends in flexible workforce settings, use of digital tools, and consumer buying behavior. These growing trends will produce a “new normal” and leave a lasting impression on the CRE landscape. New winners and losers among property sectors will undoubtedly emerge along the way.

Randy Fuchs

Randy Fuchs